Underlying Issues and Facts

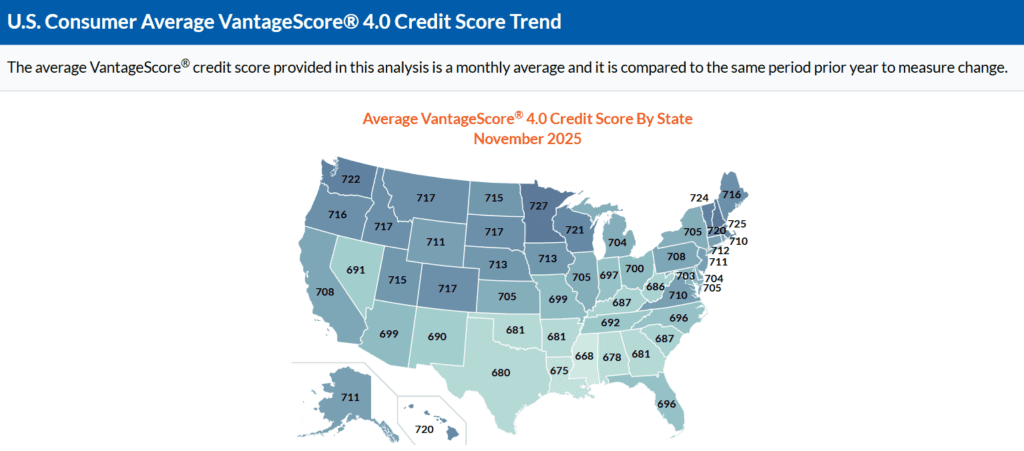

There are only 3 states that have lower credit scores than Georgia

Only three states have lower credit scores than Georgia.

Because Georgians lack access to lawful credit repair services, the state has one of the lowest average credit scores in the nation, ranking fourth worst overall. Reputable credit repair services do more than dispute inaccurate information; they educate consumers on how the credit system works, including budgeting, responsible credit use, and long-term credit building strategies. The absence of these services in Georgia has contributed to lower average credit scores when compared to states with similar income and demographic profiles where such services are permitted

Access to for profit credit repair company services.

Everywhere else in the entire country, consumers can pay a fee and hire professional help with their credit. In Georgia, for profit credit repair is currently illegal. This needs to change! Georgians deserve the right to access legitimate credit repair companies and programs just like other US consumers. Making for profit credit repair illegal keeps out the legitimate businesses but does nothing to stop scammers from preying on Georgian consumers as they don’t obey the laws anyway.

There is a common misconception that nonprofit consumer counseling agencies in Georgia already provide free credit repair services

The fact is that 95% of the services provided by nonprofit consumer counseling services is simple debt repayment plans. These agencies do very little if any credit repair services. Credit repair is not just about paying off your debt, it’s about making sure that every negative item on a consumer’s credit report is 100% accurate, verifiable, and not outdated.

Another common misconception is that Georgia’s existing credit repair laws effectively protect consumers from fraudulent credit repair companies.

Individuals engaged in fraudulent activity do not comply with existing laws. As a result, the prohibition of credit repair services in Georgia does not deter scammers. Instead, the current statute primarily prevents legitimate and reputable credit repair providers from operating within the state. The lack of reputable credit repair in Georgia actually incentivizes scammers to market in Georgia because without legitimate businesses there is less advertising competition and thereby easier and cheaper to find victims.

The current Georgia credit repair laws are just plain unamerican

In the United States, we place a high value on individual freedom and the right to choose. Restricting consumers from seeking professional assistance to improve their own credit runs counter to these principles. In other areas of complex personal finance and law—such as tax preparation or legal representation—consumers are not required to navigate the system alone; they are permitted to seek qualified professional help. Georgia consumers should be afforded the same choice when facing the complexities of the credit reporting system, rather than being compelled to manage it without professional assistance.